Things about How to Interpret and Use a Currency Volatility Meter to Make Informed Trading Decisions

A unit of currency dryness gauge is a valuable tool that can help services properly handle overseas swap risk. In today's global economic situation, providers involve in international business and administer organization deals in various money. However, fluctuations in exchange costs can easily have a substantial influence on a business's economic functionality. Therefore, it is essential for organizations to possess a clear understanding of unit of currency dryness and how it affects their functions.

Currency volatility refers to the degree of variant or change in the exchange fee of one money loved one to another over a details time frame. It is determined by a variety of aspects such as economic indicators, political activities, market view, and central bank policies. Higher degrees of currency volatility can posture significant problem for organizations operating all over boundaries.

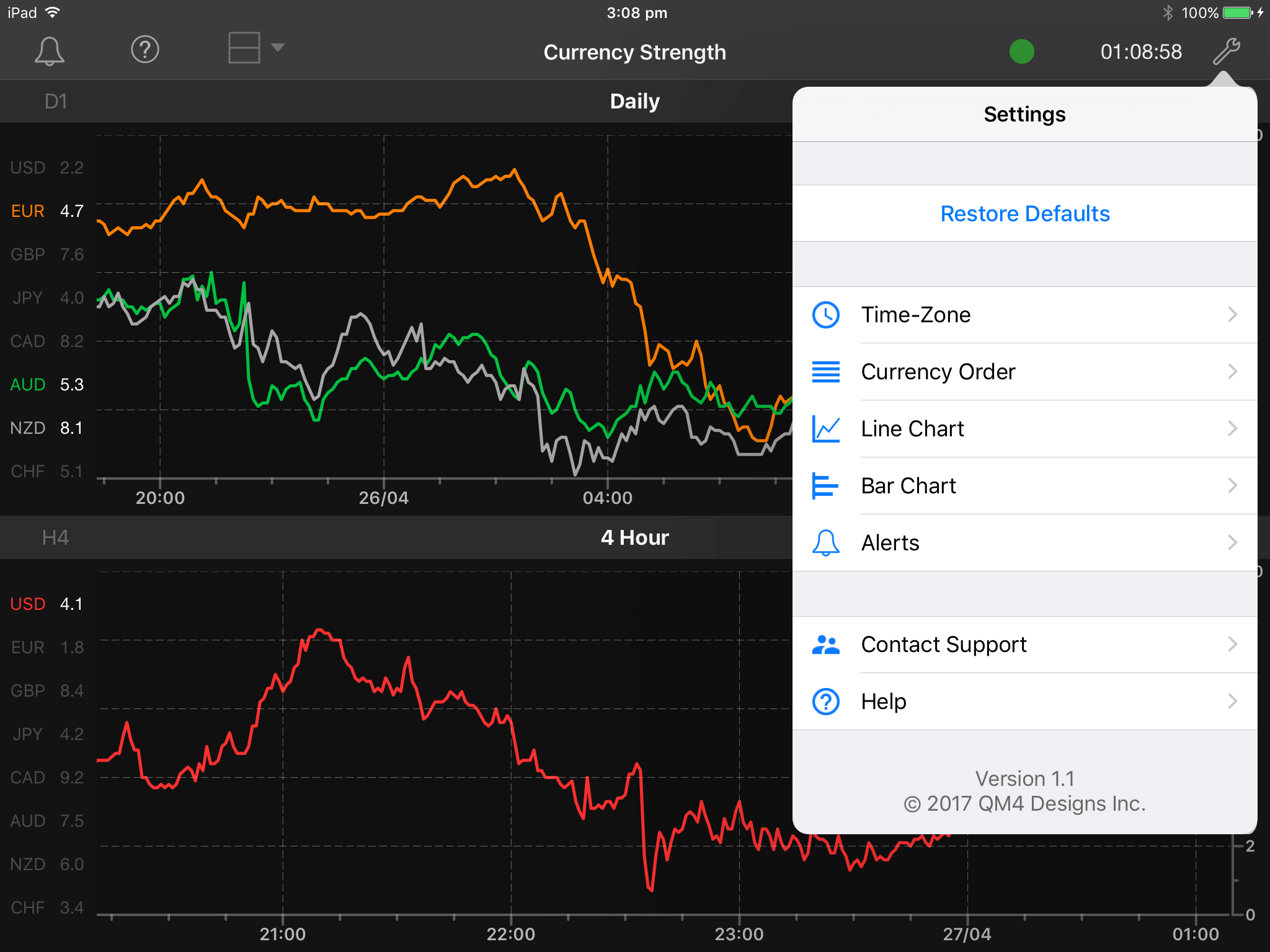

One method to gauge and check money dryness is by using a currency dryness gauge. This resource supplies real-time details on the degree of dryness in different unit of currency sets. By studying this information, companies can obtain insights into possible risks and produce informed selections concerning their foreign substitution deals.

The 1st means in which a money volatility gauge can easily aid businesses is by giving them with correct and up-to-date info on swap price activities. This relevant information allows firms to prepare for potential changes in the worth of different unit of currencies and readjust their methods correctly. For instance, if the gauge suggests high amounts of volatility between the U.S. dollar and the european, a organization might choose to hedge its exposure by going into in to forward agreements or various other derivative guitars.

In addition, a money volatility meter aids services identify time frames of heightened threat when performing global purchases. Throughout opportunities of raised volatility, there is actually higher anxiety concerning potential substitution fee movements, which can easily reveal companies to possible reductions if they are not sufficiently prepared. By keeping track of the analyses from the meter, providers can take proactive solution such as adjusting rates methods or branching out their provider foundation to mitigate these risks.

Yet another advantage of utilizing a currency dryness meter is that it allows organizations to assess their total visibility to foreign exchange danger effectively. By evaluating the volatility degrees of different money pairs, firms can easily pinpoint which currencies pose the highest danger to their functions. This makes it possible for them to prioritize danger monitoring efforts and assign resources as necessary. For case, if a service imports a considerable volume of fresh components coming from a country along with a unstable money, it might think about sourcing alternatives or arranging long-term source contracts.

In addition to measuring unit of currency dryness, some enhanced meters additionally give businesses with anticipating analytics and scenario study resources. These function enable providers to mimic different instances and assess the possible influence on their financial efficiency. Through performing Currency Strength Meter , companies may develop contingency program and make much more informed selections regarding their foreign swap methods.

Moreover, a unit of currency volatility meter can easily aid companies improve operational productivity by automating particular tasks related to foreign exchange danger control. As an alternative of by hand tracking exchange fees and assessing market data, business can rely on the gauge's real-time updates and alarm. This relieves up beneficial opportunity for financing crews to concentrate on additional calculated activities such as forecasting cash money circulation or building risk mitigation approaches.

In verdict, a money volatility gauge is an crucial resource for organizations running in today's global economic climate. It provides correct information on exchange fee activities, helps pinpoint time frames of elevated risk, determines exposure to international swap threat, delivers predictive analytics capacities, and improves working effectiveness. By leveraging this device effectively, services can easily handle international substitution threats extra effectively and create informed selections that guard their economic efficiency in an increasingly unclear worldwide industry.